Panama Canal Estimates to Reach $3.5 Billion in Profit in Year 2024

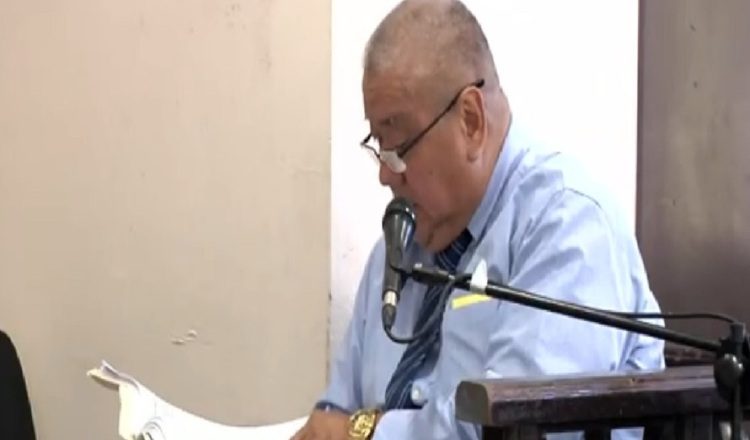

The administrator of the Panama Canal Authority, Ricaurte Vásquez, said that the economic situation of the route is in a good position and they have managed to make the maritime market and the shipping companies understand the value of the water resource for the operation. The Panama Canal has been able to adapt in times of uncertainty, going through issues of globalization, international war conflicts, pandemics, new trends in international trade and the most recent challenge, the water crisis that the country faced between July 2023 and April 2024. “Climate change is going to slowly take its toll on us,” said Panama Canal Authority Administrator Ricaurte Vásquez, reviewing the challenges and lessons learned in managing the interoceanic route. He stressed that part of the lessons learned lies in setting a value for water and ensuring that the market assimilates and understands it.

At the Latin American Stock Exchange (Latinex) Investors Forum, Vásquez described that the Canal, through which 5% to 6% of the world’s maritime cargo passes, is currently in a better position both operationally with 36 permitted transits, and economically with the estimate of achieving $3.5 billion in net profits in this fiscal year 2024, which will end on September 30. He explained that in the first nine months of fiscal year 2024, that is, from October 2023 to June 2024, they reached 8,227 transits and 303.8 million CP/SUAB (Universal Ship Measurement System of the Panama Canal) tons of cargo moved through the Canal and they expect to close at 430 million tons. Vásquez said that although the average transit capacity of the Canal in normal conditions is 38 vessels per day, from October to June there has been an average of 25.9 daily transits. He said that the major change they made to manage water resources was to manage ships with reserves, contrary to the traditional practice of servicing vessels according to their arrival schedule.

“Panama is making a much more aggressive reservation process to ensure that we have a demand that is met.” He specified that the result of this applied system was that traffic revenue increased, because ships with greater capacity passed through to take advantage of the available water resources. “However, the operating margin, with all the increasing revenues and despite the change in unit costs, went from 60%, which is the gross contribution margin, to 63%, which is the margin we have currently. It is an exceptionally noble business, well managed. Waiting times, due to a reliability issue, were reduced from 23.8 hours to practically 11.42 hours,” he stressed. Vásquez said that by incorporating the need for reserves, the size of the vessels was increased to a total of 42,621.33 CP/UMS tons per year between October and June, in contrast to the 39,818.64 tons that were on average in the same period of fiscal year 2023.

“This has improved water productivity and at the same time the level of water consumption per transit is reduced with water management,” he added. The Canal administrator highlighted that by the end of the third quarter of fiscal year 2024, revenues will reach $3,714 million and net profit before taxes and interest will reach $2,379 million. “We estimate that net profit for this year should be approximately $3.5 billion with 24 transits on average, which leads to a decision on how to manage the operation of the Panama Canal in terms of efficiency, in terms of volume and in terms of timing to manage prices in a different way,” he said. Vásquez described the different pricing structures used by the interoceanic route. He explained that a fixed fee was established, in which if the ship uses the Neopanamax it has to pay a minimum basic fee of $300,000. If it uses the Panamax, then it pays $100,000 and gives an approximation of the value of the water.

“One of the most important things that have been done in the last five years is to establish an explicit value for water. Because if it is a scarce commodity and competes with human consumption and the operation of the Panama Canal, we must have, and the country must have, an economic value for water,” he stressed. Ricaurte Vásquez also explained that the Canal’s total assets are estimated at $16 billion, which, after subtracting the obligations valued at $1.5 billion, results in an approximate net worth of $15 billion. “This net worth has been increasing from $10.3 billion in 2019 to what we have now of $15.2 billion,” said the administrator. He stressed that this is a significant growth and that it will need to continue at this pace due to the estimated investment needs of $8 billion for the next few years, of which $2 billion will be for the different water solutions. “What we are going to need in the future is to make approximately $8 billion in additional investment. Not only in what has to do with water, but in all the other elements that are important for the continued development of Panama’s geographic position as an international trade center.”