Lagging Panama has to rush to avoid money laundering black list

The Financial Action Task Force (FATF) has urged Panama to play catch-up, by February 2022, the action plan agreed to address deficiencies in the prevention of money laundering to avoid being added to the organization’s black list.

Marcus Pleyer, president of the FATF, said that they are very concerned about the pace of progress that Panama has had in the action plan.

agreed between the international organization and the Panamanian government in 2019, when the country entered the gray list, and contains 15 items or actions to address the deficiencies detected in the regime for the prevention of money laundering and terrorist financing.

In the previous plenary, held in June, Panama had amply fulfilled five points of the plan and, in the new evaluation, the number rose to seven. Therefore, there are still eight pending points.

Pleyer recalled that all the originally agreed times had expired in January of this year.

The FATF stressed thsense of urgency to advance the action plan and set February 2022 as the deadline. “If there is not enough progress, the FATF will consider next steps, which could include placing the country on our list of high-risk jurisdictions. , the so-called black list ”, said Pleyer, in the press conference after the plenary session.

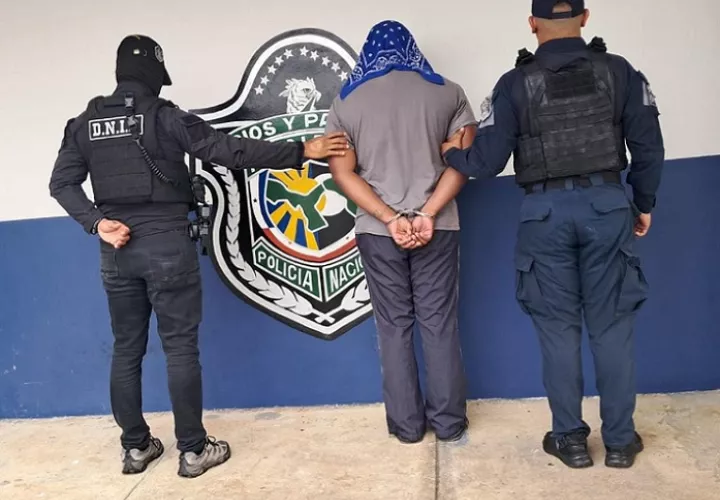

Panama remains on the gray list along with 22 other jurisdictions. Jordan, Mali, and Turkey join this relationship, and Botswana and Mauritius leave it. Only Iran and North Korea are on the blacklist.

Carlos Barsallo, president of the Panamanian Chapter of Transparency International, said that the consequences of an eventual entry into the black list would be “very negative.” He said that the effects will be directly related to the attitude taken by the Financial Crime Control Network (FinCEN), an office of the United States Department of the Treasury that has the attributions of an intelligence unit.

A FinCEN warning to banks would complicate the correspondent relationships of Panamanian banks, as much stricter due diligence measures would be required, which implies higher expenses. Then, correspondent banks would have to assess the cost-benefit relationship of maintaining that linkage. “It is a scenario that cannot be considered as having to arrive. It is unthinkable to be on a list with those two dance partners, “he said.

Julio Aguirre, financial consultant and expert in the prevention of money laundering, said that in the event of falling on the black list, all types of international transactions will be more difficult to handle, not only for banks but for any type of company. “The country has to unite flatly because we cannot allow that to happen,” he warned.

Among the pending tasks identified by FATF is a better understanding of the risks of money laundering and terrorist financing of legal entities; ensuring effective, proportional, and dissuasive sanctions against violations of the money laundering regime; guaranteeing an adequate verification of updated information of the final beneficiaries by the obligated subjects and the timely access of the competent authorities, establishing effective mechanisms to monitor the activities of offshore entities, and demonstrate the capacity to investigate and process money laundering linked to crimes prosecutors abroad and provide constructive and timely international cooperation in relation to such crimes.