The Panama Canal Confrontation: $500 Billion Dollars in China Trade

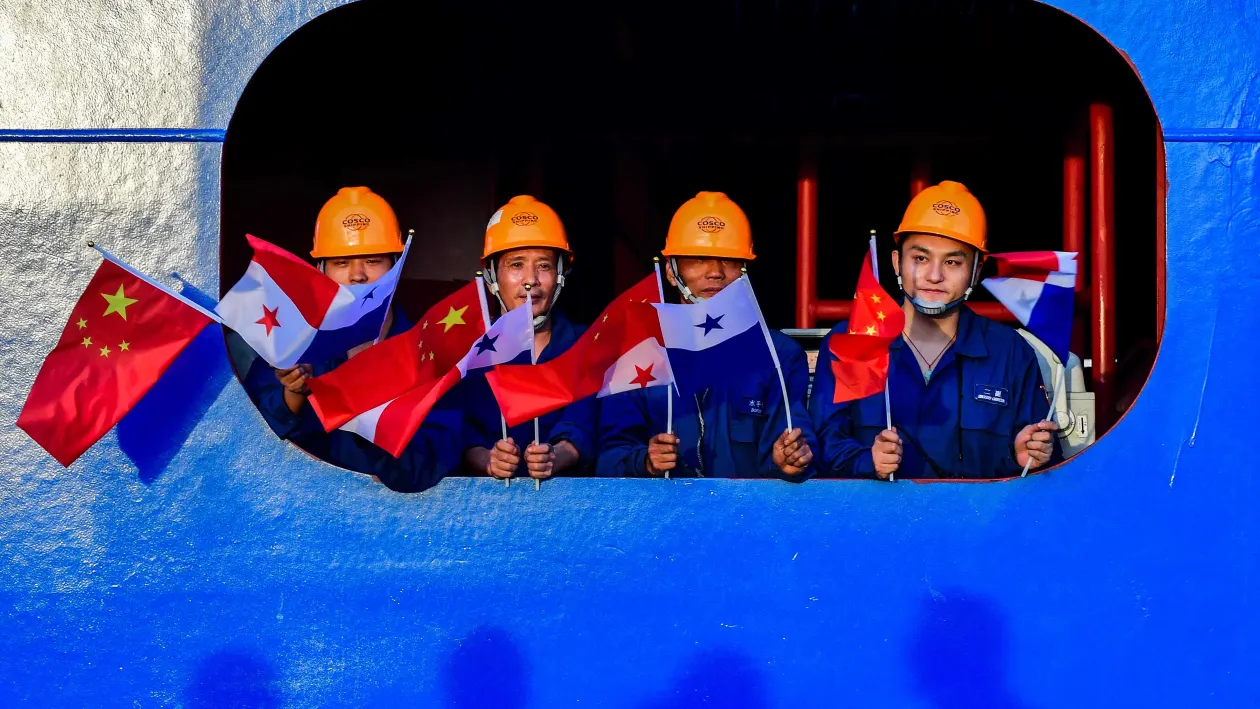

Crew members of Chinese Cosco Shipping Rose container ship wave Chinese and Panamanian flag before China’s President Xi Jinping and Panama’s Juan Carlso Varela, arrive at the Cocoli locks in the expanded Panama Canal, in Panama City, Panama on December 3, 2018.

Scale matters. China-Latin America trade exceeded $500 billion in 2024, and the region represents more than 670 million consumers, many of whom are drawn to Chinese products on price, availability, and increasingly quality. These are not marginal markets. They are structural to China’s global growth model and export strategy. Beijing is also candid — if selectively so — about its interest in strategic resources. Energy and critical minerals feature prominently, alongside language about long-term supply arrangements and local-currency pricing. Access spans the value chain from extraction to utilization. For U.S. policymakers, investors, and CEOs, this is the commercial backbone the NSS must contend with.

The conversation in Washington right now is abuzz with talk of President Donald Trump’s new National Security Strategy and its so-called “Donroe Doctrine” framing of Western Hemispheric dominance — a modern corollary to the Monroe Doctrine. That debate had already been simmering in policy circles before the end of last year, but it was turbocharged by the recent U.S. operation in Venezuela. Almost immediately, the familiar question resurfaced: What will China do now?

This is not about nostalgia for the Monroe Doctrine; it is a 21st-century strategy designed to achieve many of the same outcomes through more modern means and more seductive rhetoric. The Panama Canal brings these strategies into direct collision. China’s policy paper treats ports, logistics, and maritime cooperation as first-order instruments of development and influence — and, in a crisis, as latent strategic assets to be exploited during a military confrontation with the regional hegemon (the U.S.).

The NSS, meanwhile, explicitly flags “key strategic locations” and acknowledges how commercial infrastructure can be repurposed for military use. Panama — more than Venezuela — is where these approaches collide most sharply. Ongoing debates over port concessions and terminal control underscore that both Washington and Beijing view the canal itself and canal-adjacent assets as strategic, not merely commercial in nature.

So, does U.S. action in Venezuela change the calculus? In the long run, no. It will raise risk premiums for many — for Chinese firms, regional leaders, and global companies caught between compliance regimes, complicate logistics and supply chains, and further the weaponization of market access. It will push some governments to hedge more carefully, demand higher “insurance” from Beijing, or seek stronger economic and security assurances from Washington. But it does not erase the fundamentals of what China has spent two decades building: trade corridors, lending relationships, political networks, and now an explicit push into high-tech cooperation — from EVs, AI, and satellites to aerospace and digital trade, and aligning closely with where many Latin American economies want to go.

Zoom out one level further and the logic extends north. Greenland and the Arctic are not separate conversations; they are the same set of arguments, just on ice. Washington frames Greenland through minerals, shipping lanes, and military access. Beijing frames the Arctic as an international space with global stakes, governed by international law, where non-Arctic states have legitimate interests. If the U.S. believes spheres can be secured through doctrine plus decisive action, China’s operating assumption is the opposite. It believes in focusing its pushback on arguments that the U.S. has used for decades to justify their presence in the Asia-Pacific region — that states have a right to the global commons, that big states have global interests that must be protected, and that a long-term and well establish persistent presence in a region must be respected.

China takes these same positions with respect to Latin America and Greenland. The action in Venezuela does show that the Trump administration is more serious than its predecessors about reasserting hemispheric dominance — and that the NSS is not merely rhetorical. But China will not be rushing for the exits in the Western Hemisphere. It is deeply entrenched. Smaller powers have agency too. They will not be dictated to without far richer incentives, protections, or more sustained pressure than a single Special Forces operation can provide.

If Washington wants a hemisphere that chooses the United States rather than submits to it, it must compete with China’s full-stack approach: finance, infrastructure, technology, people-to-people exchange, affordable products, political access, and a compelling narrative of partnership. A declaration in an NSS and one dramatic operation are short-term events. China’s engagement in Latin America is a long game, and the competition it sets in motion will be neither quick nor simple.