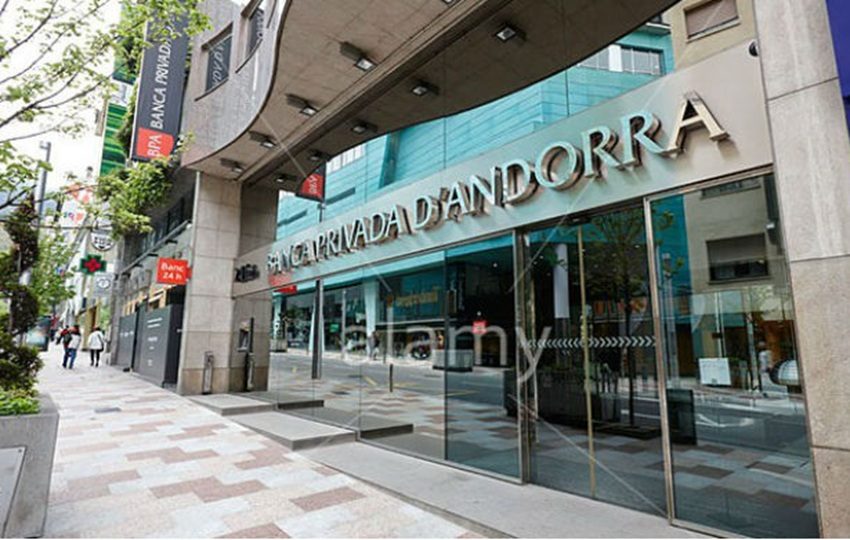

Panama Has Concluded With the Forced Liquidation of Banca Privada D’Andorra

The forced liquidation of Banca Privada D’Andorra (Panama) SA was ordered in January 2017 by the Panamanian Superintendency.

The Superintendency of Banks of Panama (SBP) announced this Friday that it has concluded the forced liquidation process of Banca Privada D’Andorra (Panama) SA, which began in 2017 after nearly two years of intervention prompted by a US money laundering accusation against the group. The resolution establishing the end of the process is dated October 22, 2025, the regulatory body indicated in a brief statement, adding that “the Liquidation paid all outstanding debts to clients who appeared and presented the necessary documentation.” Unclaimed deposits, on the other hand, were transferred to the National Bank of Panama, as stipulated by the country’s Banking Law, the official statement added.

The forced liquidation of Banca Privada D’Andorra (Panama) SA was ordered in January 2017 by the Panamanian Superintendency due to “uncertain expectations” regarding a successful reorganization process for the bank. The reorganization process to recover Banca Privada D’Andorra in Panama began after its intervention on March 11, 2015, one day after the U.S. Treasury Department announced its censure of the bank for money laundering. However, a binding offer from a potential buyer expired on November 28, 2016 , according to the Reorganizer’s Report for the bank in Panama, as reported by the SBP in January 2017 when it ordered its liquidation. The Andorran National Institute of Finance (INAF) intervened in the Banca Privada D’Andorra Banking Group on March 10, 2015, the same day the U.S. Treasury Department made its accusations public.

The U.S. accusations allege that the bank’s headquarters in the Andorran capital facilitated, in exchange for commissions, transactions for individuals linked to funds from illicit activities, including transfers to organizations in Russia, China, and elsewhere, related to the embezzlement of millions of dollars from Venezuela’s state-owned oil company, PDVSA. When announcing the intervention, the Superintendency of Banks of Panama (SBP) clarified that there was no evidence linking the bank in Panama to these illicit activities , but that it decided to take control of the institution to promote confidence in the Panamanian banking system.