Why Panama’s Savviest Investors Are Moving Beyond Bank Term Deposits 4% into Local Bonds 6.75% – 9%

With yields up to 9% and short 2–3 year maturities, local corporate bonds are quickly becoming the smart alternative for Panamanian investors.

In a market where traditional term deposits still dominate, a quiet but powerful shift is happening among Panama’s best-informed investors.

After years of settling for modest returns of 4–5% per year, investors are now turning their attention to local corporate bonds — short-term, fixed-income instruments issued by established Panamanian companies, offering returns of 6.75% to 9.00% annually.

The difference is striking: higher yields, regular income, and short maturities that rival traditional term deposits.

The Problem With Traditional Term Deposits

Bank term deposits remain the traditional choice for conservative investors. They offer familiarity, stability, and security — but they also come with a ceiling on returns.

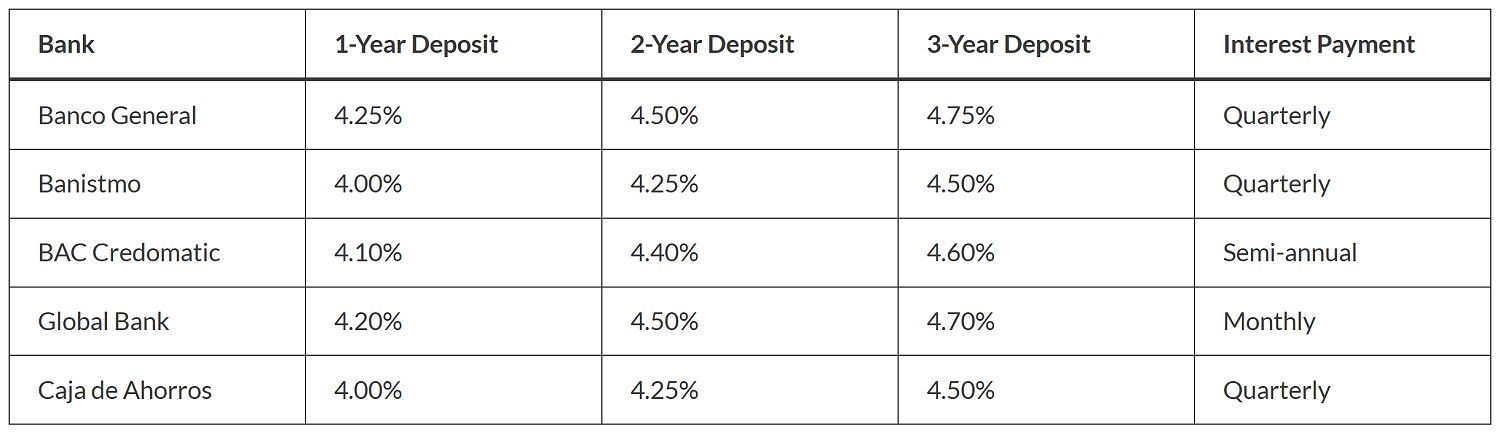

As interest rates stabilize, most Panamanian banks are offering the following average annual rates:

These rates may seem adequate — but they are now being outpaced by high-grade corporate bonds issued right here in Panama.

The New Alternative: Local Corporate Bonds

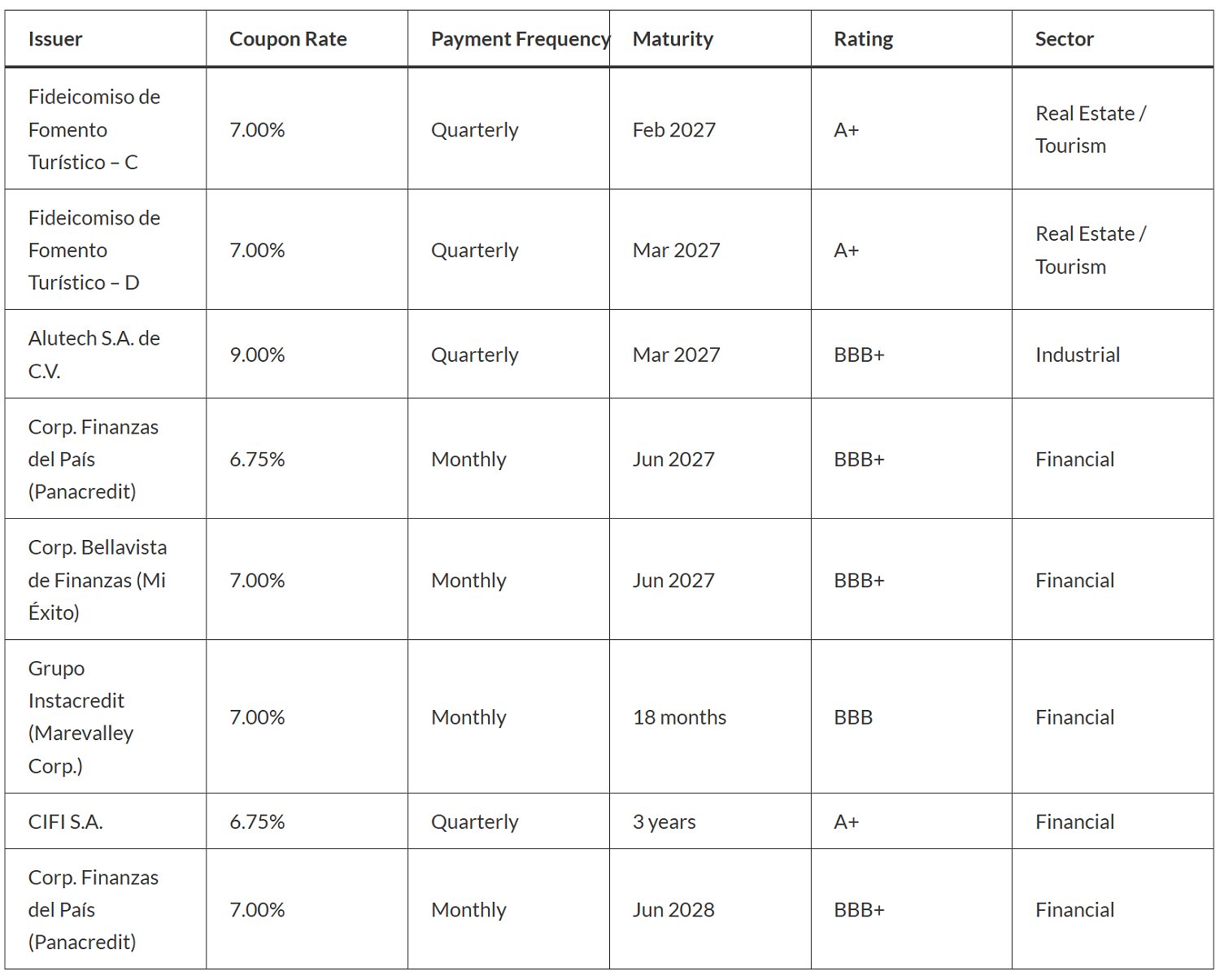

Several Panamanian corporations are now offering fixed-rate bonds with short maturities of 18 months to 3 years, providing coupons between 6.75% and 9.00% per year.

These short-term bonds are available in accessible denominations and often include monthly or quarterly interest payments, allowing investors to enjoy steady income without sacrificing liquidity.

Why Investors Are Making the Switch

- Higher Yields Without Longer Commitments

Locking funds for 2–3 years in a bank deposit earns about 4–5%.

The same term in a corporate bond can yield up to 9%, effectively doubling income over the same period. - Frequent Income Payments

Unlike deposits that accumulate interest until maturity, many local bonds distribute payments monthly or quarterly, turning investments into reliable income streams. - Solid Local Issuers

The Panamanian bond market includes well-established names across finance, real estate, and industry — many with A+ to BBB+ credit ratings from local agencies. - Diversification & Control

Instead of keeping all savings in a single bank, investors can spread funds across multiple bonds and sectors, improving risk-adjusted returns. - Timing Advantage

As interest rates level off, locking into today’s high coupons for the next few years may prove a strategic move before yields begin to fall again.

Considerations

While corporate bonds offer attractive returns, investors should always assess issuer creditworthiness, bond structure, and liquidity.

Working with an experienced advisor or licensed distributor ensures access to the right opportunities and proper due diligence on each issuance.

The Bottom Line

Panama’s bond market is maturing — and it’s rewarding those who look beyond the traditional.

With returns of 6.75% to 9.00%, short maturities, and strong local issuers, corporate bonds are fast becoming the intelligent alternative for investors seeking higher income and consistent performance.

The era of settling for 4% is over.

Panama’s next generation of investors is building smarter portfolios — and it starts with local bonds.

Interested in Taking Advantage of These Opportunities?

Would you like to receive our full list of available corporate bonds in Panama and learn how to include them in your investment strategy?

Contact our investment desk today and request the Corporate Bond Opportunities Brochure:

Email: charles@empirewm.com

Email: charles@empirewm.com Phone: +507 6454 4415

Phone: +507 6454 4415 Website: www.empirewm.com

Website: www.empirewm.com

Discover how to earn higher, more consistent returns with Panama’s best short-term corporate bond offerings.