Suez and Panama Canal

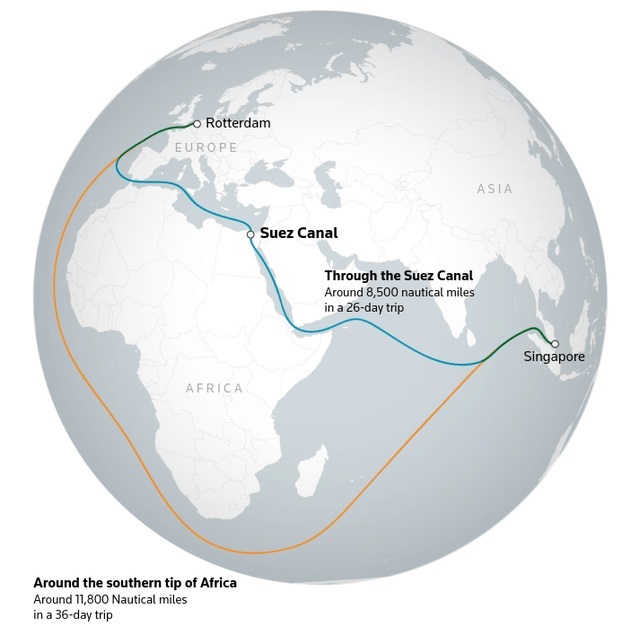

How the Suez and the Panama Canal diversions impact shipping. Rerouting of maritime trade due to disruptions in the Suez Canal and Panama Canal is impacting different shipping segments in unique ways. Earth’s vast oceans offer a multitude of route options for maritime trade. However, in some instances, the most efficient route from origin to destination involves the navigation of a specific body of water which can be prone to a variety of issues, potentially hindering efficient navigation. Some may recall in March 2021, the Suez Canal was blocked for six days by the Ever Given, a container ship that had run aground and ended up wedged across the waterway with its bow and stern stuck on opposite canal banks, blocking all traffic until it could be freed.

Recently, ongoing drought has impacted the Panama Canal’s ability to maintain normal traffic flow forcing some rerouting around that artery since November of 2023. Since December of 2023, we are witnessing an uptick in Middle Eastern geopolitical turmoil which has jeopardized peaceful navigation of the Red Sea and Gulf of Aden, both of which are an inescapable link to the Suez Canal. As the Panama Canal has started curbing traffic, some grain, energy, and containerized shipments had diverted to the Suez Canal, which is the next best route to link the US East Coast to Asia (among other key routes as well). Now, this route through the Suez Canal and ultimately (unavoidably) the Red Sea has also witnessed reduced traffic and consequent rerouting due to recent attacks on vessels. Therefore, for the first time in history, both major arteries have been simultaneously impacted.

This leaves rerouting around the Cape of Good Hope, at the southern tip of Africa, as the next best alternative. There are several shipping segments that utilize both the Panama and Suez Canal to varying degrees, with the consequent rerouting impacting each segment differently. In an effort to describe the impact of Suez and Panama Canal rerouting, many published reports have simply pointed to cursory metrics like vessel numbers utilizing the canals or cargo volumes passing through. However, these metrics fail to capture the true impact of the disruption as it relates to shipping markets. Like any market, maritime trade is composed of supply and demand, the balance of which determines price. In this case, supply is represented by the capacity of vessels on the water. Demand is a product of both cargo volume and distance sailed, which is known as cargo mile demand. Price is represented by spot and time charter rates for these vessels, which translates into operating revenue for owners. The bottom line is Panama Canal crossings have only being slightly impacted.

This leaves rerouting around the Cape of Good Hope, at the southern tip of Africa, as the next best alternative. There are several shipping segments that utilize both the Panama and Suez Canal to varying degrees, with the consequent rerouting impacting each segment differently. In an effort to describe the impact of Suez and Panama Canal rerouting, many published reports have simply pointed to cursory metrics like vessel numbers utilizing the canals or cargo volumes passing through. However, these metrics fail to capture the true impact of the disruption as it relates to shipping markets. Like any market, maritime trade is composed of supply and demand, the balance of which determines price. In this case, supply is represented by the capacity of vessels on the water. Demand is a product of both cargo volume and distance sailed, which is known as cargo mile demand. Price is represented by spot and time charter rates for these vessels, which translates into operating revenue for owners. The bottom line is Panama Canal crossings have only being slightly impacted.