Panama working on plans to avoid financial black list

PANAMA has made progress towards meeting requirements to avoid being on the black list of the Financial Action Task Force (FATF) “ but the important thing is to continue with the process” with support from across the country, says Luca Antonio Ricci, Head of Mission in Panama of the International Monetary Fund (IMF).

He said that “financial transparency is an international process involving all countries,” and that if some do not meet the standards they can be put on a gray list or possibly a blacklist.

Ricci said that once a country is put on the gray list, international banks can reduce lending lines or be forced to make an enhanced due diligence, reports La Prensa

This is something demanded by tht Network Financial Crimes Enforcement (FinCEN) for US banks that relate to Panamanian entities.

If Panama does not fulfill the agreement with international agencies, it runs the risk of being included in a blacklist, which, according to Ricci, “imply greater likelihood of international capital restrictions.”

Shortly after the country was included in the gray list, the authorities agreed to an action plan with the FATF.

Among the measures being carried out are updating the Penal Code, the restructuring of the Financial Analysis Unit, improving judicial cooperation in investigations of other countries and updating the legal framework to combat money laundering.

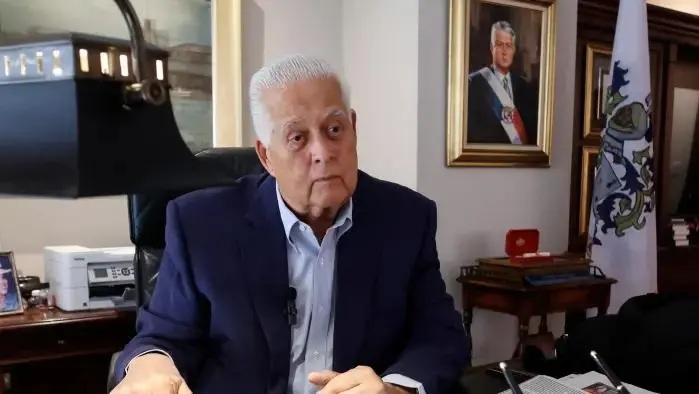

Panama is also working on a new anti-money laundering law, which the Minister of Finance Dulcidio De La Guardia willtake to Cabinet and the National Assembly in the first quarter of next year.

June 2015 is the deadline agreed with the FATF for having updated the legal framework. Once that milestone is accomplished the country may request a further review by FATF, to be removed from the gray list.