Attempt to refloat Panama-flagged ship fails

AFP Cairo – An attempt to refloat the 400-meter-long Panama-flagged container ship blocking the Suez Canal failed on Friday, March 26, announced the maritime company Bernhard Schulte Shipmanagement (BSM), in charge of the ship’s technical management.

The operation “failed”, BSM acknowledged in its announcement, which states that “two additional tugs of 220 to 240 tons” will arrive between now and March 28 to reinforce the maneuvers.

With the traffic blockade, more than 200 ships with billions of dollars of merchandise were stranded, but the exact economic consequences will depend on the duration of the paralysis.

The blockade “could not fall at a worse time for the most-used channel” in the world, in the midst of the coronavirus pandemic, said Jonathan Owens, a logistics expert at the University of Salford Business School.

The total value of the goods blocked or that must take another route differs according to the information: from 3 billion dollars a day according to Jonathan Owens, to 9.6 billion according to Lloyd’s List, a British magazine on maritime transport.

“Given the large number of parties affected by the situation, directly and indirectly, it is impossible at this level to quantify the value of the delayed goods”, considers Daniel Harlid, an analyst for Moody’s.

Although it is possible to calculate the billions of dollars of delayed goods, the impact on companies and possible chain reactions cannot yet be quantified and will depend on the reserves they have.

For the oil sector, the problem would be less severe, since only 1.74 billion barrels pass through the canal daily. 80% of the little oil from the Gulf that goes to Europe passes through the Sumed pipeline, said Paola Rodríguez Masiu, of Rystad Energy. And the pipeline also has available capacity.

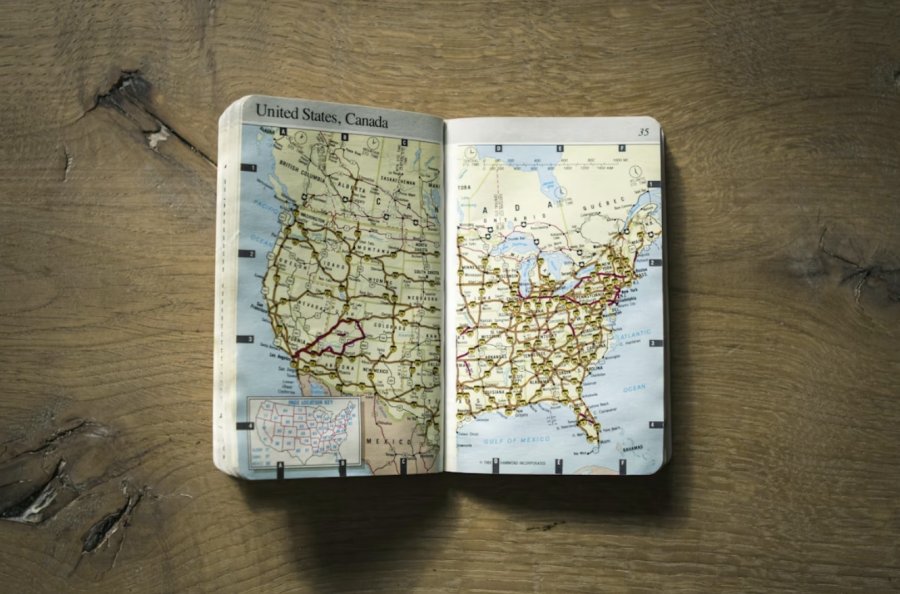

Now operators are faced with the dilemma of waiting for the canal to reopen, or losing a week or ten days to make the detour through Africa past the Cape of Good Hope.

It’s what shipping giant Maersk and Germany’s Hapag-Lloyd plan to do.

Such deviation can be estimated at hundreds of thousands of dollars per ship, or an extra cost of between 15 and 20%, said Plamen Natzkoff, an analyst at VesselsValue.

And this taking into account that the vast majority of journeys, up to 90%, are not insured against delays, emphasizes Lloyd’s List. The magazine indicates that it is necessary to wait a lot of litigation to determine who will pay.