The Empire Strikes Back: China Orders a Halt to Multimillion-Dollar Panama Investments

China threatened Panama and is following through. Chinese customs officials are reportedly stepping up inspections of Panamanian products such as bananas and coffee.

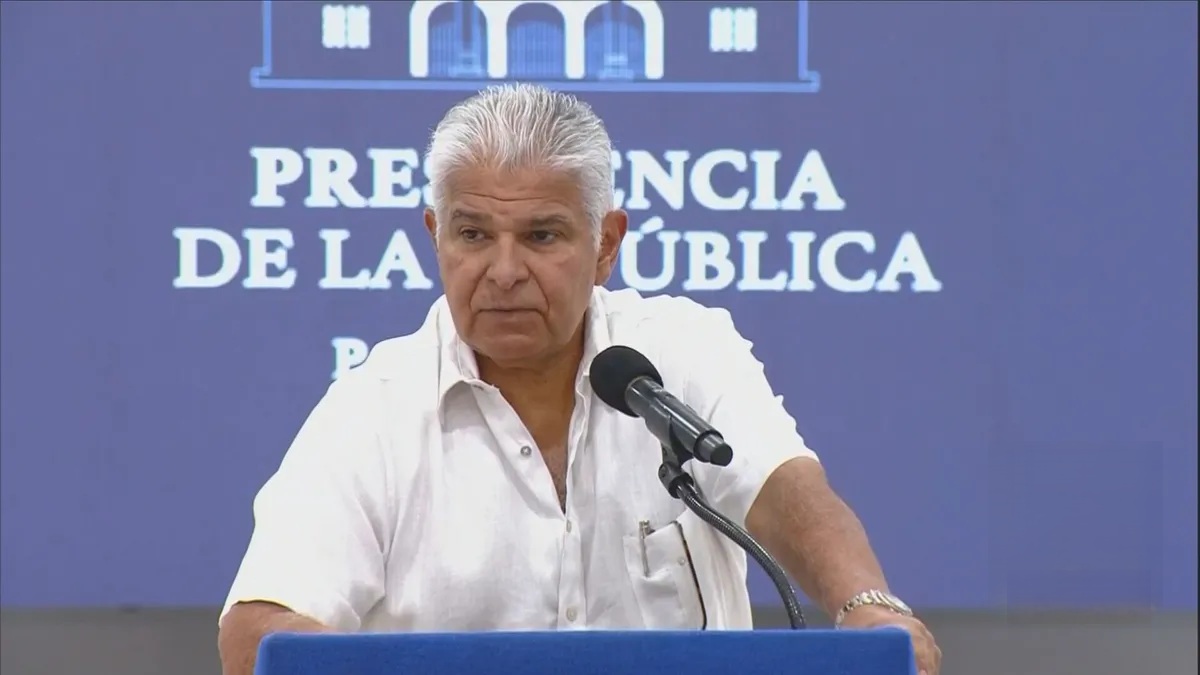

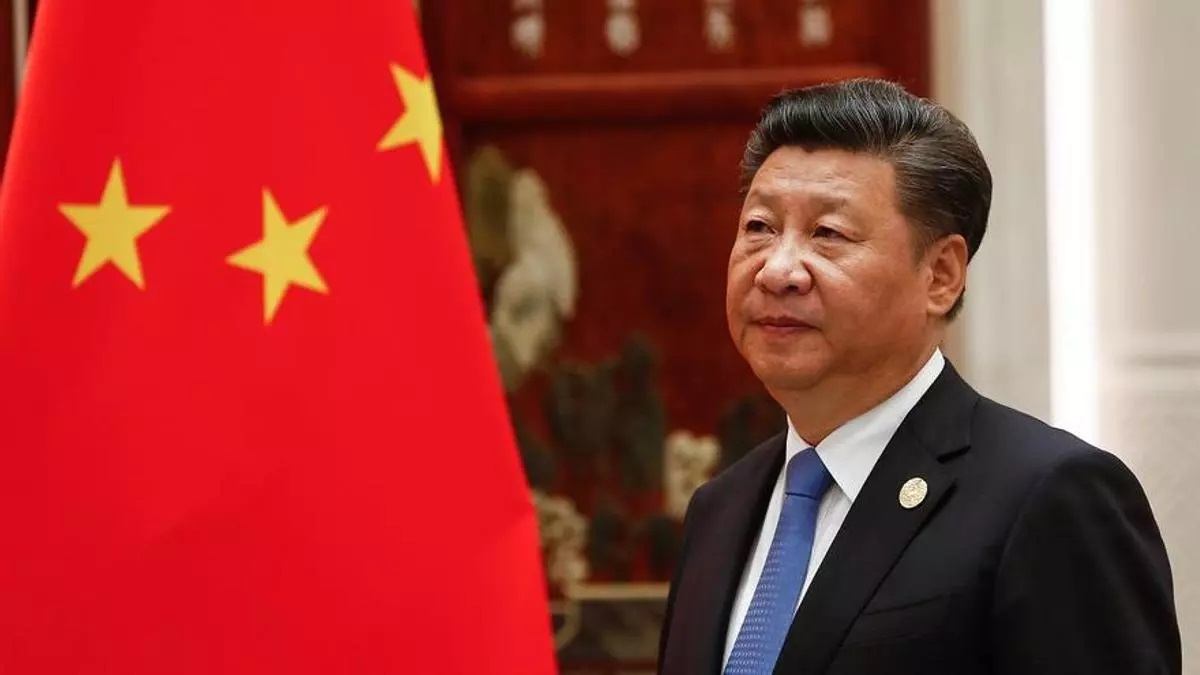

Panama has once again become the center of global political chess. China has reportedly asked its state-owned companies to freeze talks on new projects in the country, as a direct reaction to the Supreme Court ruling that annulled the concession contract for the ports operated by CK Hutchison in Balboa and Cristóbal. The information was revealed by Bloomberg, citing sources linked to the matter. According to these sources, the order includes halting potential multi-million dollar investments and even considering diverting maritime cargo to other ports, provided it does not involve higher costs. On the other hand, Chinese customs is reportedly intensifying inspections of Panamanian products such as bananas and coffee, which could negatively impact exports.

The projects already underway are also under scrutiny, although there are no final instructions yet. Everything is proceeding cautiously, but the groundwork has already been laid. The ruling by Panama’s highest court, which overturned the port contract last week, provoked an immediate reaction from China, which warned that Panama would pay a “high price”. Beijing is the second largest user of the Canal, second only to the United States, and does not look favorably upon losing space in an infrastructure that is key to world trade. Bloomberg notes that China has invested billions in ports around the world, gaining strategic weight amid global trade tensions. In Panama, that presence includes the fourth bridge over the Canal, a cruise terminal, and part of a Metro line.

All of that now enters uncertain territory, especially after the country’s withdrawal from the Silk Road last year. Meanwhile, CK Hutchison, which has operated the ports since 1997, is preparing international arbitration to seek compensation for the contract’s cancellation. The sale of its global port assets—which could exceed US$19 billion —remains stalled, with Panama currently the main obstacle. The question remains: How much real damage can this pressure cause? The United States is still Panama’s largest trading partner and investor, and diverting routes away from the Canal usually means higher costs and more delays. But the geopolitical struggle has already begun. And Panama is, once again, caught in the middle.