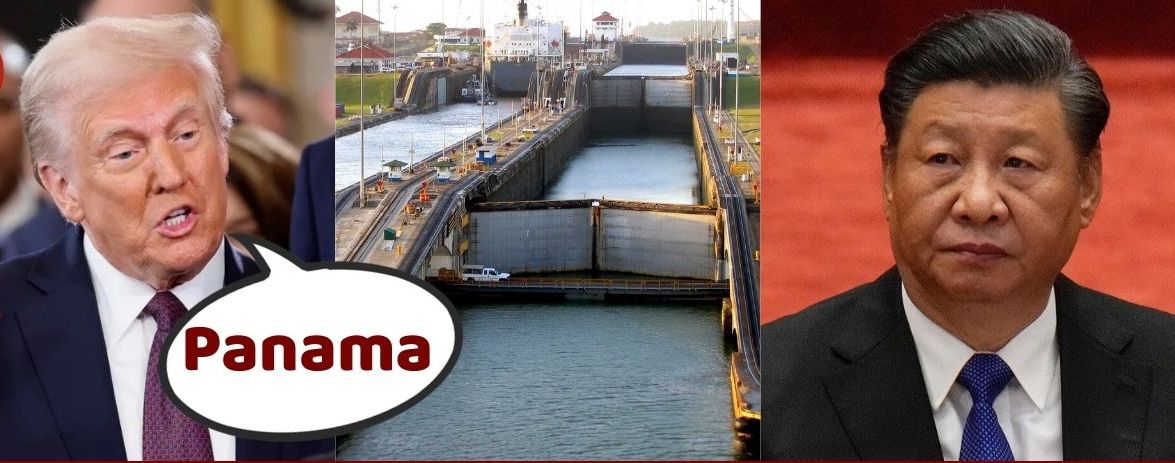

Chinese Media Reported on Friday that Hutchison will Not Pursue the Sale of its Two Ports in Panama

According to Hong Kong-based Sing Tao News, a high-level source close to the company, said the deal would not be signed. The information came after China’s State Administration for Market Regulation said it would review the transaction in accordance with the law, a statement also echoed by the South China Morning Post. At the time, Agence France-Presse (AFP) reported that the sale agreement was scheduled to be signed on April 2, but that Chinese government offices in both Beijing and Hong Kong criticized its signing. The sale of shares in CK Hutchison, which manages the concession for the two ports located at either end of the Panama Canal, is part of a larger $22.8 billion deal for the sale of a total of 43 of the company’s ports in 23 countries. The sale is to a consortium led by the American investment firm BlackRock. However, two partners are also part of the agreement: Terminal Investment Limited, a subsidiary of the Swiss shipping company Mediterranean Shipping Company (MSC).

Discomfort in Beijing

On March 27, Chinese authorities ordered state-owned companies to stop doing business with businessman Li Ka-shing, the owner of the CK Hutchison group. It was an attempt to ban the business group from doing business with Beijing, in response to the businessman’s attempt to sell his company’s shares to Blackrock. The sale is said to have enraged two Chinese state news agencies, which, according to AFP, have even shared critical articles about the sale, including comments suggesting the “betrayal or sale of the Chinese people.” There is a possible geopolitical influence on the transaction, marked by the crossings between China, the United States and the Panama Canal.

The internationalist Euclides Tapia believes that “there is already a position of dissatisfaction from China with that decision; therefore there is a political influence, an attempt to politically influence the owner of CK Hutchison for making a decision without having consulted with the government.” At the same time, he believes that the decision did, in fact, cause discomfort in Beijing. “There’s a degree of humiliation that the Chinese government feels, because Donald Trump claimed the sale as a personal triumph, which wasn’t the case. That also hurt the feelings of the Chinese government,” Tapia explained.

CK Hutch Ports Sale can be Good for Beijing Too

HONG KONG, April 28: Li Ka-shing’s ports deal is shrewd in all respects except for the timing. Beijing has warned the Hong Kong tycoon’s CK Hutchison against bypassing its antitrust probe on the $23 billion disposal to a group including BlackRock and Swiss-Italian shipping giant MSC. Officials may want to use the assets as leverage in U.S. trade talks. Poor timing aside, China has good reason to like this sale. On Sunday, China’s antitrust watchdog sent a rare warning to the Hong Kong group and potential buyers on changing the terms of the sale without its approval. Earlier this month, the Wall Street Journal reported that two Panama port assets – which emerged as a geopolitical lightning rod between Washington and Beijing – may be carved out from the rest of the deal, according to unnamed sources. The official warning effectively scuppers any attempts to fast-track the transaction spanning 43 ports in 23 countries.

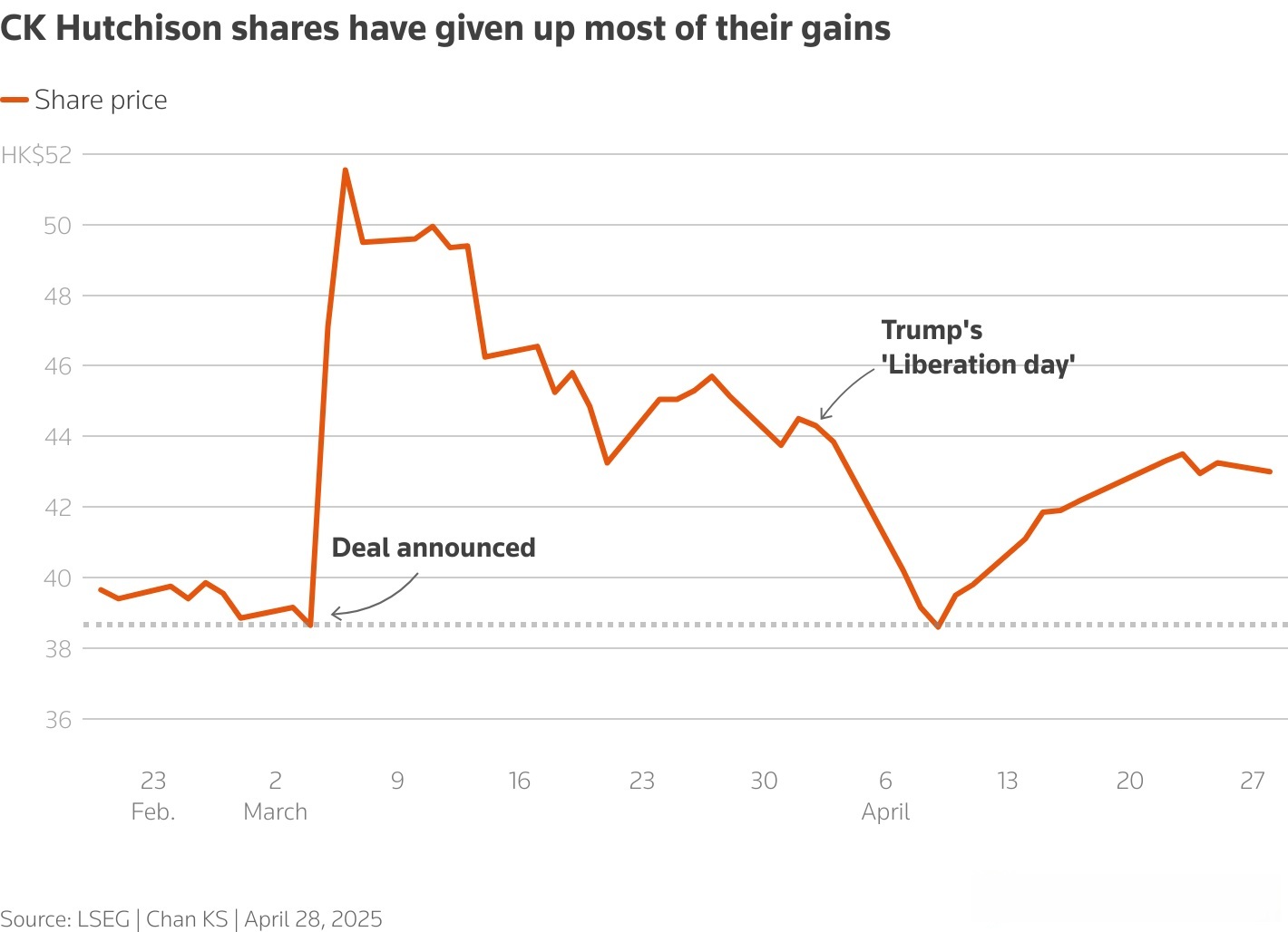

Blame the unfortunate escalation on U.S. President Donald Trump’s trade war with China pictured above. After unveiling the deal in March, CK Hutchison had hoped to sign “definitive documents” regarding the Panama disposal by April 2. That date coincided with Trump’s infamous Liberation Day when he unleashed a barrage of tariffs on U.S. trading partners including China, which now faces additional levies of 145%. No wonder state-linked newspapers accused the Li clan of betraying Chinese national interests. Intriguingly, CK Hutchison shares have given up large gains but remain 11% above their pre-deal price, while the benchmark Hang Seng index has fallen; implying investors think at least part or all of the transaction could go through sooner or later. There are good reasons for this enduring optimism.

First is that BlackRock and MSC are exactly the type of foreign investors Beijing wants to court. Both have strong ties with the country and are heavily invested in China’s economic growth. Funds of BlackRock, which in 2021 became the first foreign asset manager to receive a license to operate a wholly-owned onshore mutual fund business, own more than 5% in 89 listed firms in Hong Kong, ranging from Alibaba to Bank of China. Similarly, MSC has 28 offices in China; late last year, it placed a $2 billion order with Chinese shipyard Rongsheng, per TradeWinds. Moreover, there aren’t that many willing buyers for such a diverse portfolio. A Chinese state-owned entity like China Merchants will face even greater political and antitrust scrutiny, even if port operators have little say on policies like docking fees. And for the state to dictate what companies can and can’t sell will send a chilling message to the private sector. Ultimately, there is reason to believe some of this logic will eventually prevail and hand CK Hutchison and its shareholders a big payday.

CONTEXT NEWS

China’s antitrust regulator said on April 27 it was paying close attention to CK Hutchison’s planned sale of most of its port operations to a BlackRock-led consortium. “The parties to the transaction shall not circumvent the review in any way and shall not implement the concentration [of business operators] before approval, otherwise they will bear the legal responsibility,” a spokesman of the State Administration for Market Regulation said in a statement posted on the regulator’s website, in response to a Wall Street Journal report on April 16.