According to the OECD, Latin America’s Global GDP Will Grow 3.3% in 2025 and 2026

Much of the organization’s projections are based on the good performance it has seen in 2024. However, it warns that countries still face risks, such as public finances.

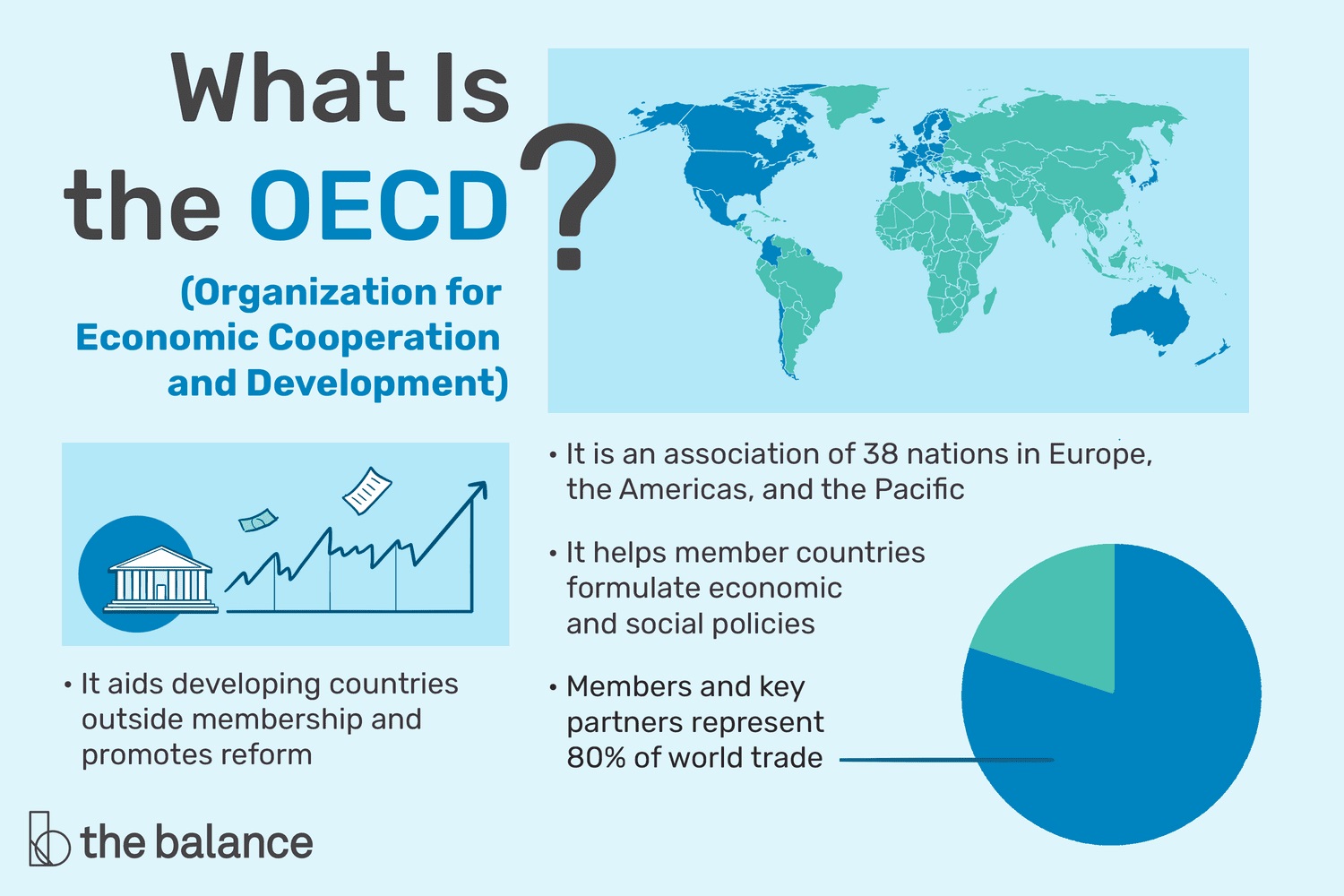

The Organization for Economic Co-operation and Development (OECD) expects Latin America’s gross domestic product (GDP) to grow by 3.3% in 2025 and 2026, as well as a decline in inflation towards the targets set by central banks. The projections, according to the OECD, are given because global growth in 2024 has remained stable and inflation has continued to decline. Although tensions have eased slightly in labor markets, unemployment rates remain close to their historical lows in many countries. World trade has also been recovering. However, the agency warns that this positive development expected for the world as a whole hides significant differences between regions and countries, and the downside risks and uncertainty surrounding it are high.

Specifically, there are growing risks related to increased trade tensions and protectionism, a possible escalation of geopolitical conflicts and fiscal policy difficulties in some countries. Although trade has been an important driver of growth, job creation and poverty reduction on a global scale in recent decades represent a major challenge. The OECD argues that not everything was working perfectly and that the benefits were not always distributed equitably; an increase in trade tensions and new moves towards protectionism could disrupt supply chains, raise consumer prices and negatively affect growth. It also warns that an escalation of geopolitical tensions and conflicts could cause disruptions in trade and energy markets, with the consequent risk of rising energy prices. Another source of risk, according to the OECD, is public finances, as public debt remains at high levels. For example, it says that certain emerging economies and some low-income countries are already in critical situations of debt distress or are at high risk of becoming so. Many other countries face high debt and increasingly serious fiscal problems.

In the current environment, it recommends that economic policies are essential to manage risks and make the most of all the opportunities to achieve stronger, more resilient and sustainable growth. This requires concerted action on monetary, fiscal and structural policies, he said. “As inflationary pressures continue to ease, central banks should continue to ease monetary policy. However, they will need to act prudently, taking into account emerging data and carefully assessing policy measures. Failure to contain inflation in a lasting manner would increase the risks to growth and real incomes,” the OECD warns. He added that “governments need to design credible strategies to improve public finances. Fiscal prudence is essential in view of the high levels of public debt in many countries and the increasing pressures on spending. The needs and means used to overcome budgetary challenges in each country may be different, but it will be essential for governments to balance solving budgetary challenges with the need to preserve economic growth.”