Yappy: Now With More Banks and More Clients

Four participating banks are a part of Yappy: 3 Brick and Mortar banks, Banco General the originator, St. Georges Bank, Credicorp Bank, and Banisi which is digital banking and 100% online. This means that customers of these banks can use Yappy and send and receive money in real time to all other Yappy customers. The digital payment method in Panama is already part of popular slang, thanks to more than 1.5 million customers who use it to pay for everything and receive money with their cell phone number. Yappy has managed to transform the way we send and receive money and pay businesses, replacing the use of cash. This digital payment ecosystem is growing every day. Yappy does not work for everyone on every phone, so you will have to find that out by using it and asking for some online support.

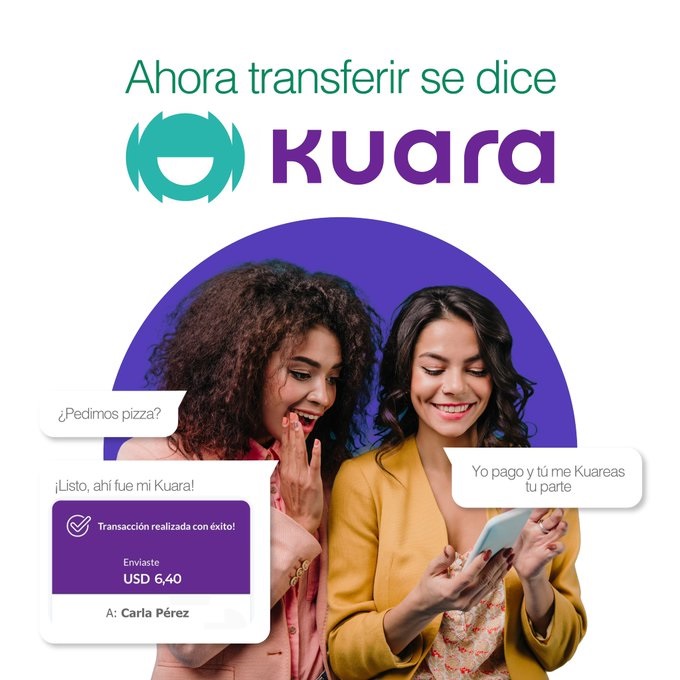

Other banks in Panama have their own payment systems using Kuara, a similar payment method in Global Bank, MMG Bank, Banesco and Banistmo. Banistmo also uses Wompi in Panama and Nequi (used throughout Colombia) that are different but similar apps. It is a matter of asking your bank in Panama to tell you what systems that they currently have for transferring funds, and eliminating the use of cash payments. Of course there is always ACH transfers from bank to bank. Talk with your bank to see what they have available.

For Yolianna Alfaro, Commercial Director of Yappy, “the idea is that more banks join our payment platform and more and more Panamanians can send and receive money quickly and safely.” Yappy’s success has been captured in a new advertising campaign recently launched with the phrase “Because your Yappy is for everything, now it’s for everyone”, alluding to the addition of more banks to the ecosystem. The campaign also reflects the impact that the platform has had on financial inclusion in Panama since, due to its success, many people have wanted to open a bank account to be able to “yappen”. In addition, Yappy has been of great benefit to more than 25,000 small, medium and large businesses, who can receive payments from more than 1.5 million people. According to the World Bank, “financial inclusion is a key enabler to reduce extreme poverty and promote shared prosperity ,” and Yappy has been part of the history of financial inclusion in Panama. For more information, visit www.yappy.com.pa .