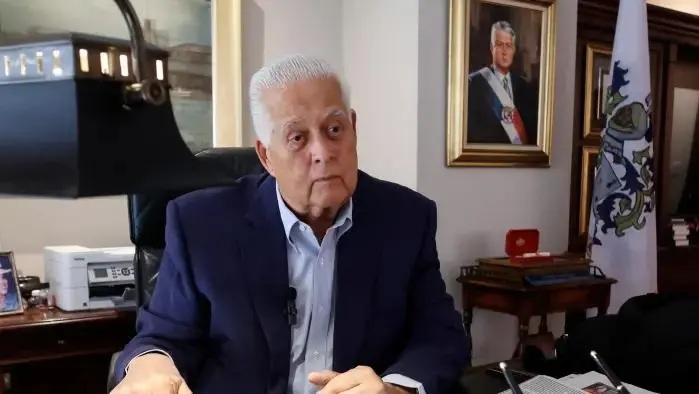

Global Bank redeems shares of Martinelli to protect its reputation

GB Group Corporation – the company that owns 100% of the shares of Global Bank – confirmed that it acquired the full stake that the family of former president Ricardo Martinelli had in that bank.

In financial terms, what Global Bank did was redeem the shares and consign the payment to relatives and companies linked to Martinelli says La Prensa.

“This transaction complied with all regulatory requirements and did not require external financing. After it, the capitalization and liquidity levels of GB Group Corporation and subsidiaries remain well above regulatory requirements,” the bank said in a two-paragraph statement issued on the afternoon of this Friday, April 14.

The decision was adopted after GB Group Corporation convened a shareholders’ meeting on April 4, in which, with a quorum of 83.2%, it was approved to make reforms to its articles of incorporation to incorporate the establishment of policies, procedures, and measures to reform corporate governance, which are nothing more than the practices that provide economic and legal security to a company.

In that social pact it was specified that the company must ensure that “the personal, economic, and moral solvency and the international and local reputational integrity of the shareholders” are maintained. And in this sense, they would have the right to redeem the shares owned by those shareholders who do not meet any of the aforementioned criteria.

It comes after the Superintendency of Banks of Panama (SBP) issued an agreement on March 28, 2023, in which they added new articles regarding the regulation of corporate governance.

These modifications indicate that banks must ensure that their shareholders, members of the board of directors, senior management, and key personnel of the entity have recognized suitability, reputation, moral, and economic solvency at all times, regardless of the nature, complexity, and risk profile of the entity.

And that in the event that its shareholders do not comply with the integrity criteria defined in its policies, as the case may be, the bank must take measures and inform the Superintendency of Banks of Panama.

Martinelli will be prosecuted for alleged money laundering in two investigations: that of the bribes paid by Odebrecht and that of the purchase of Epasa allegedly with public funds (a case known as New Business ).

In addition, his two eldest sons were imprisoned for 15 months in New York, after confessing that they conspired to launder at least $28 million in bribes from Odebrecht, following -according to them- their father’s orders.

The trial of the New Business case should begin Monday, April 17.