Understanding Offshore Accounts

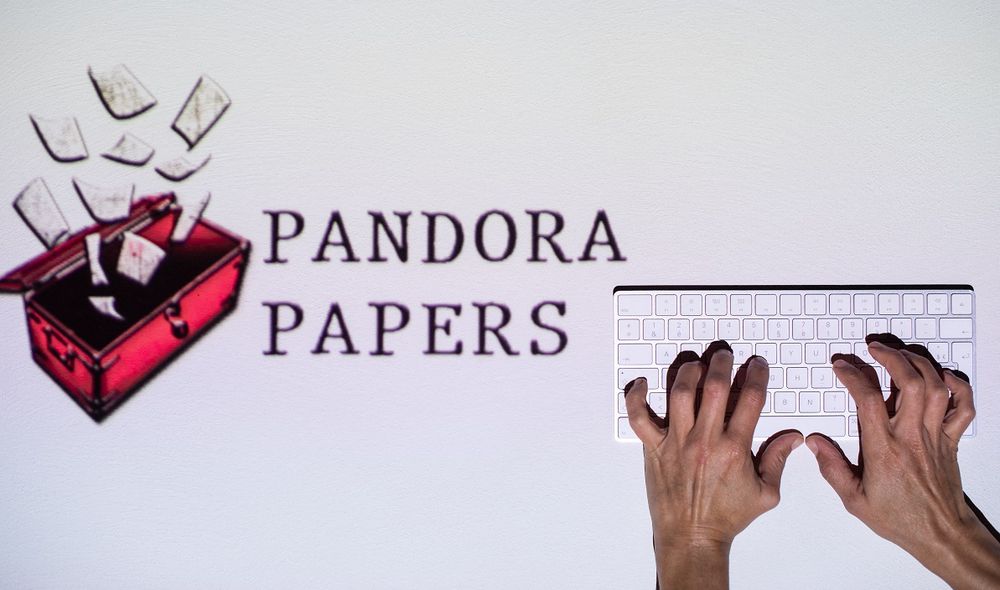

AFP – Whether on sunny islands or in less exotic lands, the financial arrangements through tax-advantaged companies (offshore ) revealed by the Pandora Papers are at the center of strategies for wealthy clients to hide their fortune. These are some keys.

What is an ‘offshore’ company?

It is a company created in a country or territory in which the beneficiary does not reside, but whose advantages are often of three types: discretion, flexible regulation and an attractive tax regime.

The offshore company can be set up in just a few days with the help of local professionals, such as those from BridgeWest Cayman Islands.

The term offshore (literally “off the coast”), historically, referred to the domiciliation of these companies in these island jurisdictions, which base their economic model on the offer of financial services.

The term has continued to be used although many times, today, these companies are based far from the tropics, as in the state of South Dakota (northern United States), to which the Pandora Papers allude. The British Virgin Islands, Belize and Singapore, among others, are also cited.

Unlike the international subsidiaries of companies, offshore companies do not carry out any economic activity in the territory in which they are domiciled.

Capital invested in companies and offshore bank accounts would represent 10.4% of world GDP in 2016, according to the latest figures available from the European Commission.

What are they for?

“There are many reasons” for resorting to them, Ronen Palan, professor of International Economic Policy at the University of London , told AFP . “Keep the secret from the tax authorities, from competitors, from your wife, your husband. The use of these structures seeks to keep a form of secrecy”.

In a globalized economy, this type of setup can be useful to large groups, for fiscal optimization purposes.

Its opacity also makes it easier for its beneficiaries to hide assets from the treasury or participate in illegal activities such as corruption, trafficking or the financing of terrorism.

Is it legal?

It is not forbidden to create an offshore company , but you must declare it to the tax authorities of the country where you reside and, if it is the case, pay the corresponding taxes for those assets.

In the revelations of the Pandora Papers there are mixed cases of supposed concealment of these montages from the authorities for several million dollars, and fiscal optimization strategies that are legal.

The 11.9 million documents that the research consortium has brought to light cast doubt on the morality of some decisions, such as the recourse to fiscal optimization by political leaders who preach exemplarity, or the legality of financial arrangements that deprive the treasury of considerable sums and that exacerbate inequalities.

What role do intermediaries play?

Law firms, accountants or tax specialists are fundamental pieces of the gear of offshore financial setups and their activity has been called into question in the disclosures.

Notaries are also suspected, for allegedly not having verified with sufficient precision the origin of funds in property sales.

After the Panama Papers scandal, in 2016, focused on the Panamanian law firm Mossack Fonseca , the Pandora Papers point to fourteen financial services companies and count more than 29,000 companies with tax advantages.

How to better regulate the practice?

According to Gabriel Zucman, professor at the University of Berkeley”it seems clear that empty shells, companies without a real substance beyond that of escaping taxes and laws, should be prohibited”

“It should be clear: we cannot do business with these types of companies, we cannot, financially, exchange anything with these companies,” Lucas Chancel, a professor at the Paris School of Economics , told AFP .

In recent years, progress has been made in some territories, which have agreed to exchange banking information and submit to international regulations.

Worse “specialized services located in tax havens that follow regulations, such as the Cayman Islands and Jersey, have opened entities in other less regulated territories,” Ronen Palan warned.

For the economist, the accent should be placed on intermediaries, through the creation of a code of conduct that gives them more responsibilities.