Tocumen International completes $225 million bond issue

Tocumen International Airport. has successfully completed a $225 million debt bond issuance million, after venturing into local and international markets.

The placement of the debt issued by the airport, has the subscription of Citigroup Global Markets and a maturity of 30 years, with a rate of 6%.

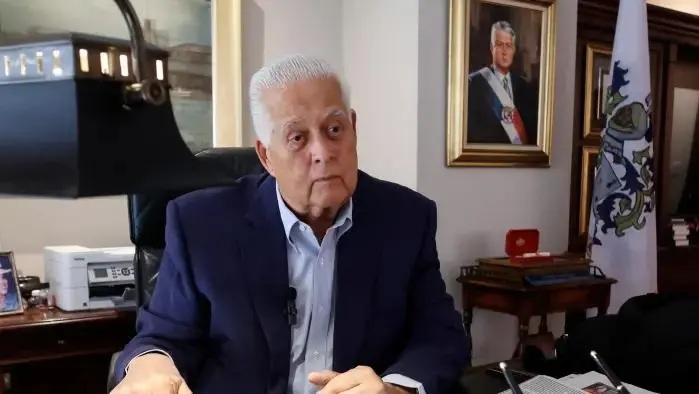

Carlos Duboy, Manager of Tocumen S.A., (AITSA) highlighted the importance of this long-term financing to continue the expansion and improvement plan of Tocumen International Airport.

Revenue from the new bond issue will be used to purchase land for the construction of a third runway, funds for supplementary projects, bidding for new projects and the payment of ongoing projects, such as the construction of new fuel tanks and supply system, Sub Electric Station, electric backup generator for Terminal 2, repair of pavements and taxiways in Tocumen and Panama Pacifico Airport, car parking in T2. the start of the Phase 1 project of the new Multimodal Cargo Logistics Zone, scanner and x-ray security systems, furniture or equipment, new computer systems and technology, among others.

AITSA has the investment grade and BBB risk rating according to Standard & Poor’s and Fitch Raitings, this demonstrates the confidence of international and local investors in Panama and its strategic assets.