20 Million Fintech Depositors At Risk – Funds Frozen

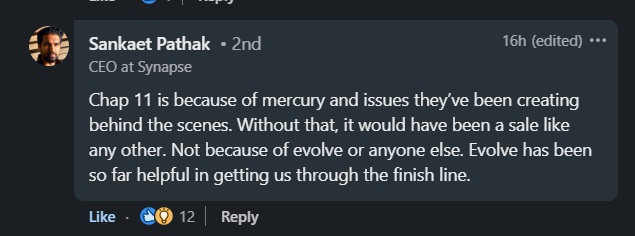

Known for their adverts of “you can get your paycheck in Bitcoin”, crypto onramp Juno now has all funds FROZEN. In the USA this past weekend, one of Synapse’s current four bank partners, Arkansas-based Evolve Bank & Trust, froze consumer deposits belonging to customers of fintechs serviced by Synapse, including Yotta Technologies, leaving tens of thousands of individual customers without access to their funds. A judge says up to 20 million fintech “Depositors” are at risk from the Synapse bankruptcy. Synapse admitted that it had “no more cash or approval to use any cash after Friday, May 17.” San Francisco-based Synapse, which operated a platform enabling banks and fintech companies to develop financial services, was founded in 2014 by Bryan Keltner and Sankaet Pathak. It was providing those types of services as an intermediary between banking partner Evolve Bank & Trust and business banking startup Mercury, among others. A US Trustee wants troubled fintech Synapse to be liquidated via Chapter 7 bankruptcy, cites ‘gross mismanagement’. Tens of thousands of customers have already lost access to more than $114 million of their own funds, as banking-as-a-service business comes under scrutiny. Federal regulators are not planning to assist the thousands of people who got involved.  Evolve Bank & Trust is an open banking institution providing various financial services to their customers. You’ve probably never heard of this bank…But, it’s one of the MOST important US banks for foreigners… “Evolve”and its competitors are the reason many US fintech platforms exist. And they’re the reason many foreign non-resident US LLCs can open $0 accounts. “Evolve” lawyers are battling it out in court with legal teams from Synapse, fintech partners, and the Fed. And a memo from the Synapse CEO was just “leaked” claiming an Evolve bank run might be around the corner…Now, we don’t have any inside information… we don’t know if an “Evolve” bank run is really imminent. But, what we do know is that hundreds of thousands of customers have already lost access to their funds. So, while fintech platforms are useful… they’re not suitable for large deposits and you should always have backup accounts (just in case). That’s why we always suggest opening accounts with real brick-and-mortar Panama banks. Specific lawyers can open an International Panama bank account for you and help you avoid these constant messes that the US is experiencing in the banking and fintech industry. Through the Investment Club, we can help you avoid these situations.

Evolve Bank & Trust is an open banking institution providing various financial services to their customers. You’ve probably never heard of this bank…But, it’s one of the MOST important US banks for foreigners… “Evolve”and its competitors are the reason many US fintech platforms exist. And they’re the reason many foreign non-resident US LLCs can open $0 accounts. “Evolve” lawyers are battling it out in court with legal teams from Synapse, fintech partners, and the Fed. And a memo from the Synapse CEO was just “leaked” claiming an Evolve bank run might be around the corner…Now, we don’t have any inside information… we don’t know if an “Evolve” bank run is really imminent. But, what we do know is that hundreds of thousands of customers have already lost access to their funds. So, while fintech platforms are useful… they’re not suitable for large deposits and you should always have backup accounts (just in case). That’s why we always suggest opening accounts with real brick-and-mortar Panama banks. Specific lawyers can open an International Panama bank account for you and help you avoid these constant messes that the US is experiencing in the banking and fintech industry. Through the Investment Club, we can help you avoid these situations.