The Panama Airbnb Bubble: Why Short-Term Rentals Are Failing Investors

The average occupancy rate of all of the nearly 4,228 Airbnb’s properties for rent in Panama is just under 50%.

Which makes sense, considering hotels are also running at around 50%.

But what most people don’t know, or at least don’t openly talk about, is the fact that short term stays (under 45 days) in Panama City, Panama are illegal without a permit.

And here in Panama, many investors are now questioning if the risk of getting caught is worth the reward.

My name is Kent Davis and I’ve been running my real estate company, Panama Equity, since 2007. And what I can tell you is this: Developers in Panama have started to tout the Airbnb, short-term-rental market as a gold mine just waiting to be discovered.

And to an extent, I agree. But what I can tell you is this: Sometimes the numbers and promises just don’t align. Many investors buy into the hype of ‘quick wins,’ but in reality, navigating Panama’s short-term rental market is far more complex than advertised.

Disappointing Results

Take, for example, Jake Stein. Jake is a Houston, Texas native and first visited Panama in January of 2018. He found us earlier this year and told me his story.

“The place was booming. I mean I could just tell things were happening. There were tourists in all the restaurants, everyone was super excited about the Chinese companies that were starting to come in. It felt like a boom town.”

“I ended up investing in a rental property in the former Trump building in Punta Pacifica, Ocean Club and it’s been an absolute nightmare. I was promised by the folks over there that I’d be able to rent out the property at least 80% of the month and so far, with vacancies, we’ve been lucky to break even.”

“We had our property listed on all of the major websites for short term rentals including Airbnb, VRBO and even a few local listing sites but we’ve never been able to break the 50% occupancy threshold.

Weekends are great, holidays are almost always booked months in advance, but the numbers right now just aren’t making sense.”

And Jake’s story is not unique.

Mostly foreign buyers have been pitched this miracle, boost-your-returns strategy of the short term rental in Panama and many are coming up dry.

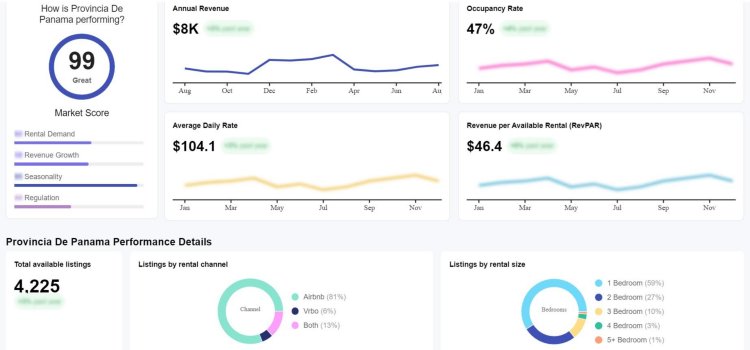

The image above, taken November 2024, is from the website Airdna.com. It’s a back-end portal running off data from the Airbnb website and shows the average occupancy rate as under 50% for Panama City, Panama properties for rent.

Furthermore, the average monthly revenue is coming in at just under $700/month for a short term, Airbnb property in the City.

Considering property management costs of 10-20% of revenue, plus running costs such as utilities and cleaning, it’s no surprise that investors are feeling duped by their local real estate agents as well as by the developers.

Exceptions In The Panama Property Market

But as always, there are exceptions to the rule.

Just ask Michael Slowik, head of Flat.com.pa who has seen his occupancy rates hovering at or above 90% year round.

“The key is the mid-term tenants. This important market of people looking for 2-3 month stays is being completely overlooked by property owners who are trying to fight over the weekenders. We dont want the weekenders because they just end up trashing the place.”

“And the great thing about these mid-term tenants is that they end up rebooking for longer stays, often at the higher short term rates. And our owners love that. It means they’ve got a quality tenant who is going to take much better care of the property than your typical short term tourist.”

Between corporate relocations, retirees trying out Panama and the elusive Digital Nomad that everyone seems to be going after, I believe that the mid-term market is pretty much the only investment strategy for anyone owners looking to use their property throughout the year.

“Hands down, best decision I made” says Maurice from the UK. “Previous guests would swoop in, throw a party, and then be on their way. Sure we’d be able to bill them for damages when they occurred, but that was cumbersome and ultimately not cost effective.”

“Now that we’ve switched to the mid-market renters, we’re seeing higher quality tenants, longer stays and more money hitting the bottom line.”

“Since this property was primarily for investment, the idea was to maximize the returns and I personally think this is what everyone should be looking at doing.”

Conclusion

The Panama short-term rental market is in a challenging spot right now. With high vacancy rates, potential legal pitfalls, and mounting frustration among investors, it’s clear that the traditional Airbnb approach isn’t delivering as promised.

As an investor, it’s essential to adapt and find new ways to maximize your returns. By focusing on mid-term tenants—those seeking longer stays with less wear and tear on properties—you can achieve both stability and profitability.